How to Create a Sustainable Monthly Freelance Income in 2026

January 30, 2026

A sustainable freelance income is a monthly income you can repeat. It covers your essentials, pays your business costs, and leaves you with a buffer for slower months. It is not about one big month. It is about consistency.

If you are freelancing in the UAE, abroad, or on a dependent visa, the challenge is the same. Work can be irregular. Payments can be delayed. Costs still show up on time.

This guide shows you a simple monthly system to earn consistent income freelancing. You will set a clear monthly target, build more predictable revenue, and use basic planning to stay stable even when client work fluctuates.

Set a clear sustainable monthly income target (essentials + business costs + buffer).

Build freelance income stability with a revenue mix: recurring monthly work + projects.

Improve freelance cash flow management by separating accounts and paying yourself on a schedule.

Use a 60-minute monthly reset to forecast income, spot gaps early, and take action fast.

Step 1: Define Your Sustainable Monthly Income Target

1. Work out your minimum monthly number

Add personal essentials, business essentials, and a safety buffer. This total is the minimum you need each month to stay stable.

2. Split your target into survival and growth

Survival covers essentials and your buffer. Growth covers savings and reinvestment. This keeps your plan steady in slow months.

3. Budget with UAE costs in mind

Costs vary by location and lifestyle. Include recurring basics like transport, mobile and internet, insurance, and fixed commitments. A buffer helps you handle slower months without stress.

Step 2: Build Freelance Income Stability With a Monthly Revenue Mix

Why one-off projects don’t create consistent income

One-off projects can pay well, but they are hard to predict. When the work ends, the income usually ends too. Then you need to sell again to fill the next month.

That cycle creates unstable months. You can be busy today and still feel unsure about next month’s income.

Use retainers to create predictable monthly income

A retainer is ongoing monthly work for a fixed monthly fee. It creates a more stable base because the client pays you regularly, not only when a new project starts.

Recurring revenue helps smooth cash flow. It reduces the pressure to constantly replace finished projects with new ones.

A simple approach is to use a mix: retainers for stability, and projects for extra income.

Package retainers so they are easy to understand

Retainers sell better when the offer is clear. Define what the client gets each month and when they get it.

Add boundaries. If the client asks for work outside the original scope, it should be treated as a change request, not “included by default.” This prevents scope creep and protects your monthly capacity.

Keep your pipeline active so next month isn’t a surprise

Stable income needs planning. Even if you are busy, keep a simple lead flow going so you are not starting from zero every month.

Track what is confirmed, what is likely, and where the gaps are. Cash flow forecasting is not about perfect predictions. It is about avoiding surprises.

Step 3: Freelance Cash Flow Management for Irregular Income

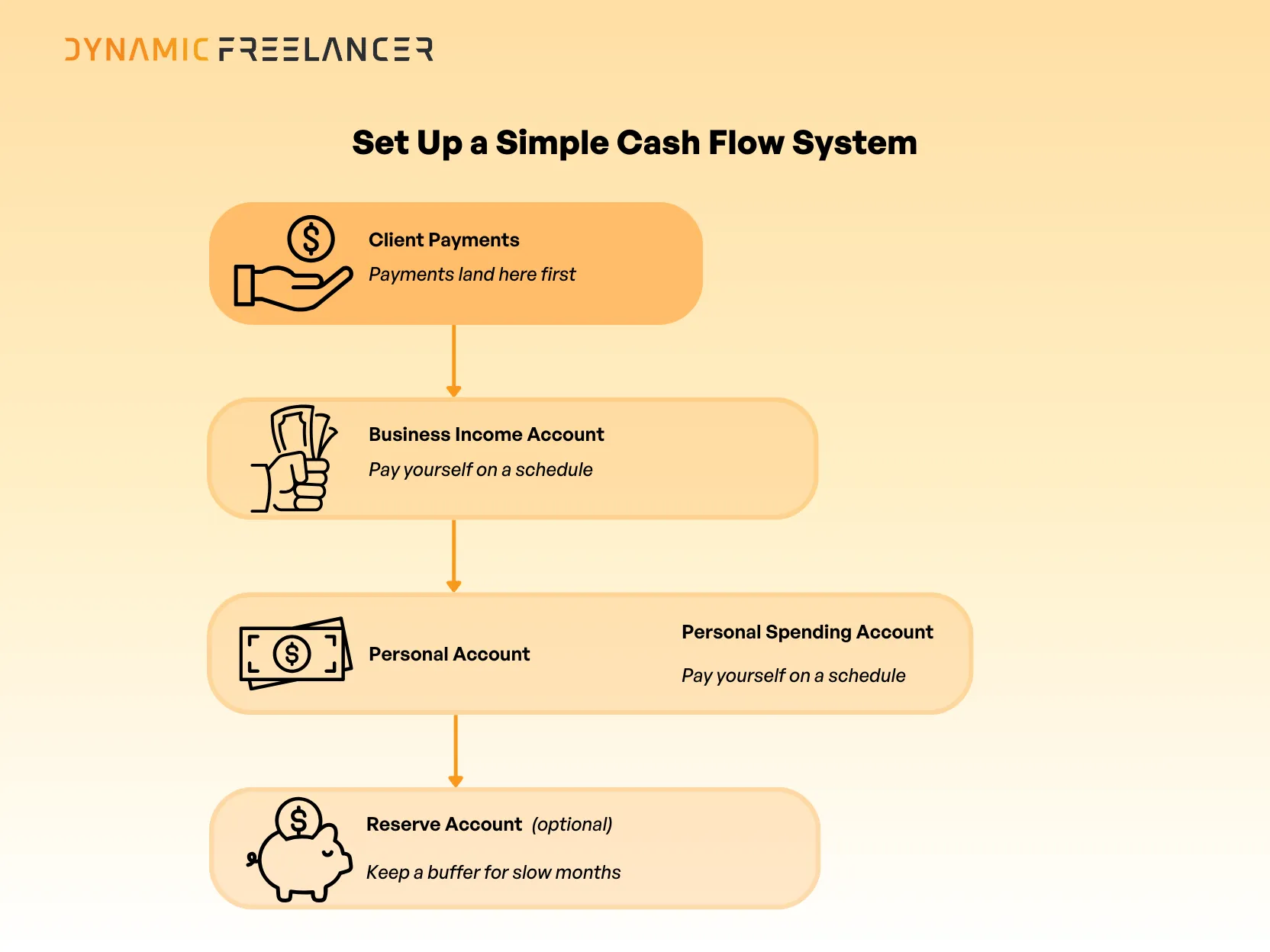

Set up a simple cash flow system (two accounts minimum)

Start by separating your money. This makes your income easier to manage and reduces stress.

Use two accounts as a minimum:

Business income account

All client payments land here first. This is your holding account.

Personal spending account

You pay yourself from the business account on a schedule.

If you want extra control, add a third account:

Reserve account

This is for future costs and quiet months. Keep it separate so you don’t spend it by accident.

How to budget as a freelancer when income changes monthly

Budget from your baseline number, not from your best month.

A simple method is to allocate money after you get paid:

When a payment arrives, keep it in your business income account.

Allocate it in this order:

Essentials and fixed commitments

Business costs

Reserve (buffer)

Personal spending (your pay)

This keeps your budget realistic. It also stops you from overspending after a good month.

Managing irregular freelance income without stress

Irregular income is normal. The goal is to make your personal income feel more stable.

Use two habits:

Build a buffer over time

Add to your reserve when you have strong months. Even small deposits help.Pay yourself a minimum draw

Choose a steady amount you can afford most months. Pay yourself that amount first, then increase it only when your income is consistently higher.

If a month comes in under your target, keep it simple:

Reduce optional spending.

Delay non-urgent business upgrades.

Focus on filling next month’s gap early with outreach and follow-ups.

This approach protects your cash flow and helps you stay steady without panic.

Step 4: Freelance Income Planning With a Monthly Routine

Monthly income tips for freelancers: the 60-minute monthly reset

Set one hour at the end of each month to reset your plan.

Review last month

Look at what brought in money, what took the most time, and what caused delays.Map this month’s income

List what is already confirmed, what is likely, and what is still missing.Choose your actions

Decide what you will do to close the gap. This usually includes outreach, follow-ups, proposals, and upselling existing clients.

This routine makes your income easier to predict. It also helps you avoid last-minute scrambling.

.webp)

A simple 30–90 day stability plan

Think in short cycles. The goal is to build stability first, then improve it.

Month 1: Cover your baseline

Focus on locking in recurring work or retainers that cover your minimum sustainable number.

Months 2–3: Reduce risk and raise value

Add a second or third reliable client so you are not dependent on one. Increase your average project value by tightening scope, improving your offer, and pricing based on deliverables instead of time.

Over time, this is what creates a sustainable freelance income that feels steady from month to month.

Common Mistakes That Break Sustainable Freelance Income

Pricing too low to ever become stable

If your rates do not cover your monthly target, you will stay stuck in volume. You will need more clients just to survive.

Relying on one client as the plan

Having one client can feel secure, until it is not. If they pause or leave, your income drops overnight.

No buffer, no system, no runway

Without a buffer, every slow week becomes an emergency. Without a simple plan, you keep reacting instead of staying in control.

Build a Monthly System You Can Repeat

A sustainable freelance income comes from a simple system. First, set a clear monthly target. Then build stable income with a mix of recurring work and projects. Manage cash flow so irregular payments do not knock you off track. Finally, use a monthly planning routine to stay consistent.

Start small. Calculate your baseline monthly number, then choose one retainer-style offer you can pitch this week.

Frequently Asked Questions

Find answers to common questions about this topic

What is a sustainable freelance income?

How can I earn consistent income freelancing?

What is the freelance clients retainer model?

What is the best way to manage freelance cash flow?

What should I do if I have a slow month?

Disclaimer: This article is intended to provide practical, up-to-date information. Details may vary based on individual circumstances, location, or changes in regulations. The information provided is for informational and educational purposes only.